The most recent PricewaterhouseCoopers U.S. Family Business Survey (2017) concludes that succession planning is a “perennial problem” for family businesses. Nearly one-third of family businesses have no succession plan at all, and just 23% have a formal documented plan in place.

One reason why so many family business owners do not engage in proper succession planning is that they view the process as difficult and complex. To be fair, it can be overwhelming to account and plan for family dynamics, career objectives of children, the state of the market in which the business operates, and how the business should be transferred, if at all, to the next generation. Further, business owners typically want to leverage their lifetime work to ensure financial support for their lifestyle after they exit the business.

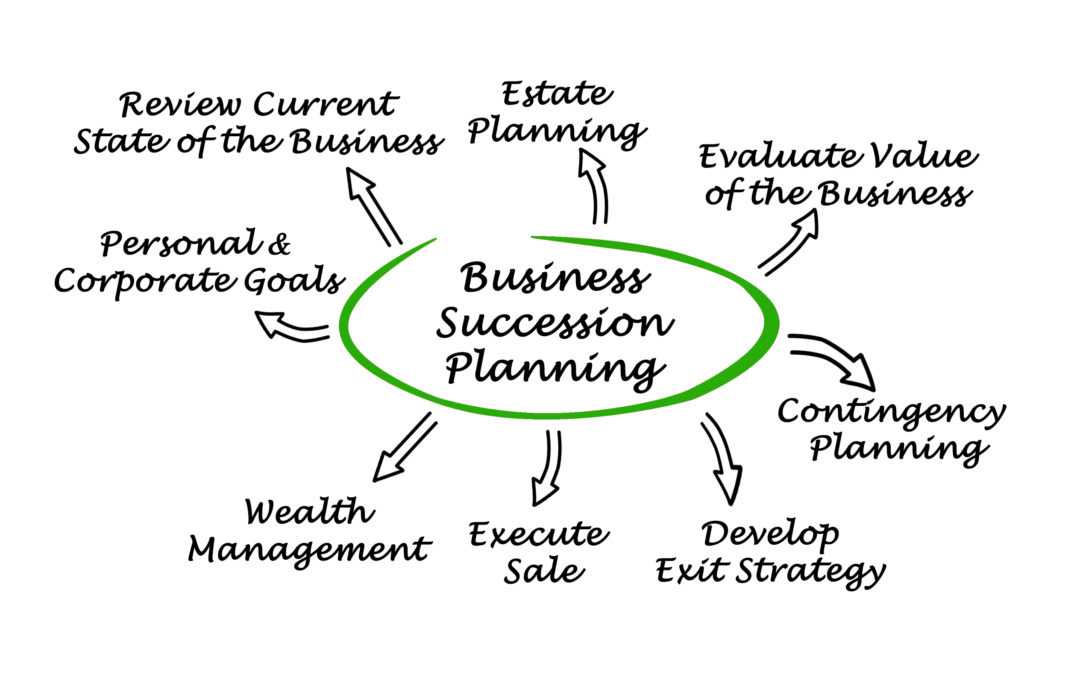

As one might expect, a comprehensive, tailored succession plan is a significant undertaking. A business owner’s exit strategy should address and take into consideration personal and business asset protection, strategies for tax minimization and value maximization, business continuity planning, estate planning, and possible lifetime transfers of ownership of the family business to the next generation.

To help business owners understand how they can construct an effective business succession plan, an experienced attorney can develop an organized, logical, step-by-step blueprint for the transfer of the business. The blueprint should provide the owner flexibility and adaptability if plans were to change, which they often do. For example, if a key employee were to leave or a third party came along offering top dollar, a well-designed succession plan would be able to adjust.

Business owners have the absolute right to determine how to transition the control and ownership in their business to the eventual successor. Planning for the eventual transition, in whatever form it takes, will take time, and the earlier one starts, the better. Now is the perfect time to begin. To get started, contact Attorney Jason S. Palmisano, who has extensive experience helping clients prepare succession plans as well as wealth management strategies and trust and estate administration. He can be reached at 561-362-2034 or email jpalmisano@pldolaw.com, or you can contact the firm’s Managing Principal and business attorney Gary R. Pannone at 401-824-5100 or email gpannone@pldolaw.com.

Disclaimer: This blog post is for informational purposes only. This blog is not legal advice and you should not use or rely on it as such. By reading this blog or our website, no attorney-client relationship is created. We do not provide legal advice to anyone except clients of the firm who have formally engaged us in writing to do so. This blog post may be considered attorney advertising in certain jurisdictions. The jurisdictions in which we practice license lawyers in the general practice of law, but do not license or certify any lawyer as an expert or specialist in any field of practice.

Recent Comments