IRS Commissioner Werfel has continued the theme from the Dirty Dozen list published in early 2023 to promulgate regulations regarding monetized installment sales. This particular brand of transaction has been marketed to high income individuals with the promise of a “penny deferred is a penny saved.” The IRS has indicated that in certain forms, these types of transactions will be deemed abusive, and subject the taxpayer to significant penalties.

These transactions seek to utilized section 453 of the Internal Revenue Code to defer gain on the sale of an asset. At its base level, the transaction occurs as follows:

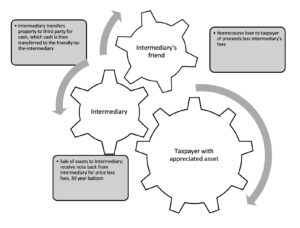

- Individual taxpayer has an appreciated asset that he sells to the intermediary- who is often also the promoter of this style of transaction.

- The purchase price is received by the taxpayer by way of an interest only balloon installment loan- often for a term of thirty years.

- The intermediary/promoter then flips the asset to the ultimate buyer for cash.

- The taxpayer will not owe tax on the gain from the transaction until the balloon comes due. So far so good…

- The intermediary, recognizing the taxpayer may not want to wait thirty years for his money, then finds another party to loan the taxpayer a large percentage of the proceeds in an unsecured, nonrecourse loan. Since the loan is nonrecourse, the taxpayer is not in receipt of the sales proceeds (arguably).

- The interest income from the original note is paid to an escrow account, which then makes payments on the second note, the taxpayer gets to deduct the interest payments made on the second note, which offsets the interest the taxpayer receives on the first note.

What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan – thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax.

What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan – thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax.

The IRS has proposed to identify monetized installment sales as listed transactions, which requires reporting. The reporting obligations would fall to both the material advisor, as well as participants, and there would be penalties if you fail to report.

If you have questions pertaining to monetized installment sales or any other tax, estate and trust planning matters, please contact Attorney Leah A. Foertsch, Managing Partner of our Boca Raton, FL office, at 561-362-2030 or email lfoertsch@pldolaw.com.