Background

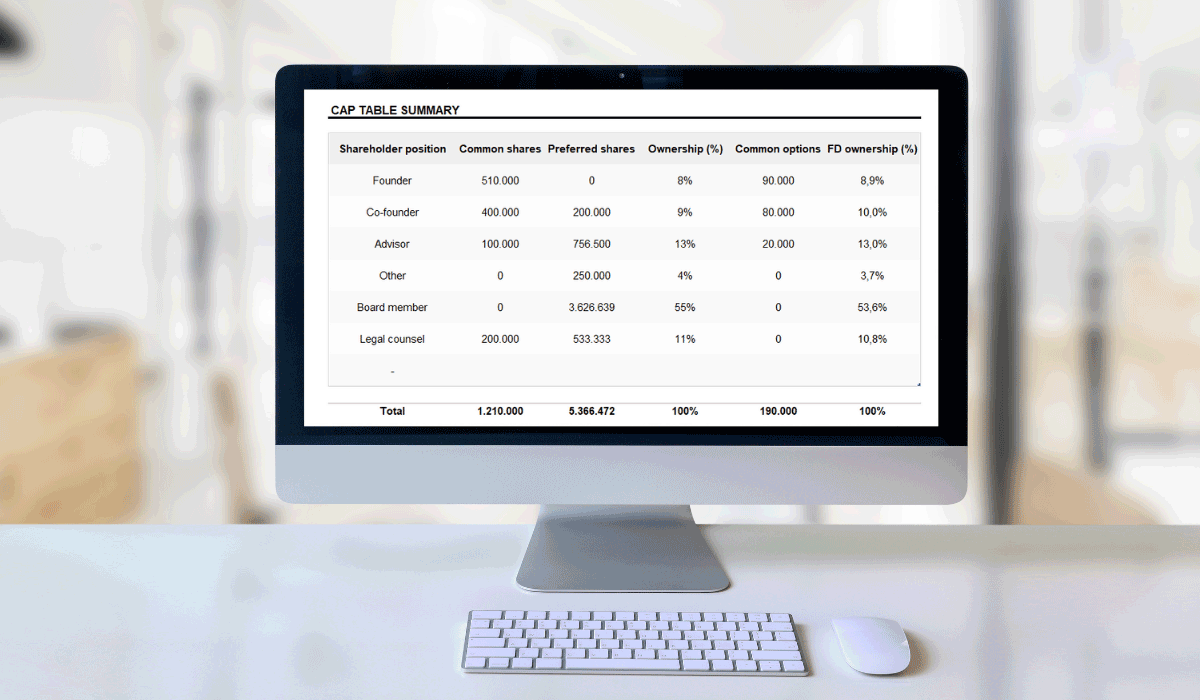

A capitalization table or “Cap Table” is simply a document that shows the current owners of a company and their respective interests in that company. In the case of start-ups and early-stage companies, the Cap Table is usually fairly simple and straightforward and is often maintained by the company or its legal counsel on an Excel spreadsheet.

As companies mature, their Cap Tables often become more complicated, since they should reflect stock options, warrants and securities convertible into equity, in addition to the current equity holders. They also should include any relevant vesting schedules or other rights of holders (e.g., put or call options, conversion rights, liquidation preferences, etc.) The increased complexity often results in companies moving their Cap Tables to one of many commercially available platforms.

Why Do I Need a Cap Table?

Although Cap Tables are not generally mandated, maintaining a current and accurate Cap Table is considered a “best practice” for privately held companies that have two or more parties. There are several reasons for that. First, a Cap Table provides a snapshot of company ownership, capital structure and the relative rights of the owners (e.g., who has voting control, are there any put or call options outstanding, etc). This can help the due diligence process for potential buyers, lenders and investors. Second, a Cap Table can be a useful tool for the company’s management team because it readily illustrates the potential impact of various structural alternatives to future financings, stock and option issuances and redemptions.

Some Practical Takeaways

For start-ups and early-stage companies, it is certainly feasible and cost-effective for the company or its legal counsel to maintain a Cap Table on an Excel spreadsheet. However, it requires discipline. If the company is keeping its own Cap Table, the company’s board should designate a member of senior management with sole responsibility for keeping the Cap Table complete and accurate in a timely manner.

The company should limit access to its Cap Table to the person designated to maintain it. This eliminates the common problem of the company having multiple versions of its Cap Table on its computer system.

The Cap Table should have a “last revised” date to make it easier to determine if it is current.

The names of shareholders are not always included on a Cap Table. However, if they are it is important to identify the securities holders in a consistent manner. Listing John Smith or Mary Jones as a shareholder and John A. Smith or Mary B. Jones as the holder of options begs the question of whether this is the same person or two different securities holders.

In conclusion, designating a member of the legal or management team to create and maintain an accurate Cap Table is recommended for companies that have more than one owner/equity holder. They are also very important when seeking investors, as they show a snapshot of a company’s ownership at a specific date. If you have questions or would like more information on Cap Tables, please contact PLDO Partner William F. Miller at 508-420-7159 or email wmiller@pldolaw.com.